Key Takeaways:

Many venture capitalists and venture capital firms like Sequoia and Y Combinator are concerned that an economic downturn is coming and are planning accordingly.

Concern stems from the possibility of a recession at the crossroads between high interest rates and overwhelming inflation due to the ongoing state of our global economy.

Looking back on the Great Recession from 2007-2009, we predict that while seed funding may be minimally impacted, early-stage or later-stage startups may want to prepare for a recession and less available funding.

What’s New?

In the event of a storm, you are taught to shelter immediately. The startup world appears to be no different. However, is this a drill or the real thing? Venture capital firms Sequoia and Y Combinator are weary of a possible economic downturn and have already advised their companies to cut-back funding substantially in preparation. Many are advising startups to achieve the “default alive status,” which sounds as grim as its meaning - become a profitable business before you use all the capital and resources you have left (1). In a time of concern, we want to give you a clearer sense of both why there is concern over a recession as well as emerging trends in 2022 facing startups so you can make the right decisions for you.

The Terrible Crossroads

While there were concerns raised by the venture capital community with the onset of the pandemic in 2020 due to a dip in global investment funding, this possible innovation dilemma was disproven. In fact, due to U.S. government stimulus checks and other financial relief given by other countries, there was actually an uptick in the amount of funding for startups. This spurred more innovation amongst growing companies, especially within the technology realm, due to the large amount of funds needed for research and development.

The first concern facing startups is the state of the global economy, which introduced more liquidity into the market due to a decrease in real GDP growth in an attempt to stimulate the market and increase consumer spending in the short-term. So, now that pandemic restrictions have eased and people are able to travel and engage in pre-pandemic activities, the market is overheating. This overheating aspect occurs when an increase in consumer spending leads suppliers to increase their prices, which then leads workers to demand higher wages, resulting in inflation. This cyclical pattern is what our economy is currently going through. In order to cool the economy down and prevent inflation, the Federal Reserve has been hawkish in their actions and raised interest rates by 0.75% to 1.5-1.75% (2). However, drastic actions taken by the Fed as well as inflation rates of 8.6% in the U.S. (and rising) have a large potential to lead to a noteworthy recession (3).

The second concern is due to the intersection of political turmoil that is only exacerbating current issues even further - Russia’s Invasion of Ukraine. This ongoing chaos has led to greater supply-chain constraints that started due to the pandemic and have made oil and gas prices skyrocket due to the trade barriers currently in place. These two central issues have led the entrepreneurial world to be in fear of a recession at the crossroads between high interest rates and overwhelming inflation.

Eye of the Storm

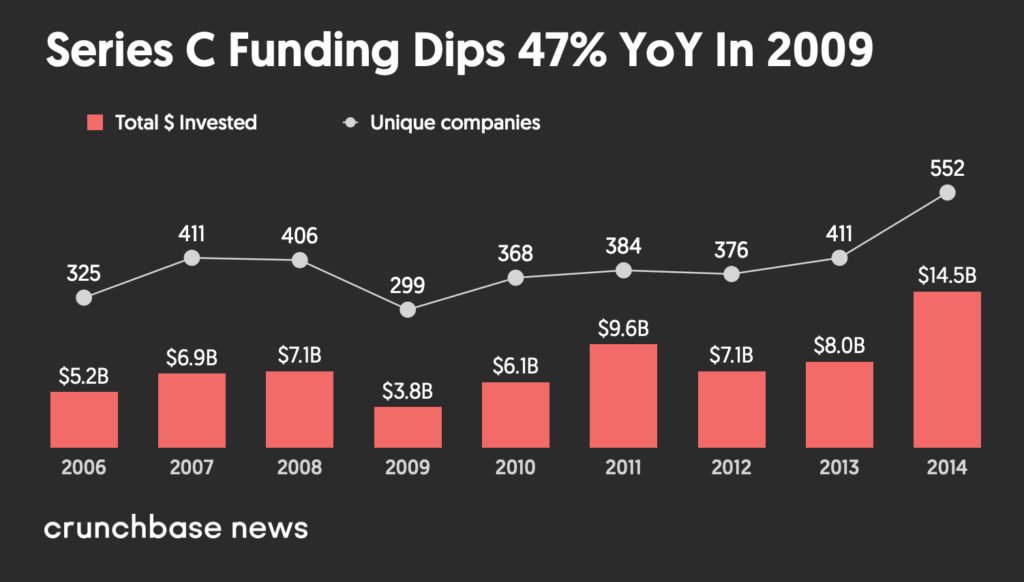

Before believing any aspiring entrepreneurs or venture capitalists should aim for the “default alive” status or seek shelter and wait for the storm to pass, not all is doomed in the world of startups. Since we at MACH37 do not have crystal balls (even though you may think we do if you look at our analytical and technology scouting reports), we believe the best predictor of future behavior is past behavior. Looking back on the most recent large-scale recession, the 2007-2009 Financial Crisis, we can get a sense for how the market may look. According to the below listed bar graphs from Crunchbase, while Series A funding declined by 40%, Series B funding declined by 42%, and Series C funding declined by 47%, seed funding still increased amidst this crisis (4). So, if history repeats itself, new innovation shouldn’t be hindered too drastically. Yet, early-stage and later-stage startups should use their funding wisely, because getting more funding in the future may prove extremely difficult to do.

While some startups may take a hit in funding, they also are part of what can help our economy out of a recession. Small-medium businesses (SMBs) make a huge contribution to the global and national economy. In fact, the U.S. Small Business Administration (SBA) states that SMBs account for almost 65% of the global GDP (5). So, while the startup space may seem dire now, it may also be what helps uplift our economy once more.

Infographic 1: Seed Funding for 2006-2014 (4)

Infographic 2: Series A Funding for 2006-2014 (4)

Infographic 3: Series B Funding for 2006-2014 (4)

Infographic 4: Series C Funding for 2006-2014 (4)

Conclusion:

While our global economy is on the rocks and the startup storm is on the horizon, seeking shelter immediately may not be in the best interest of startups everywhere. If you are in the pre-seed or seed stages of funding, dancing in the rain and gaining funding before seeking shelter is recommended. However, if you are an early-stage or later-stage startup, reaching your “default alive” status as quickly as possible may be your best hope for long-term success. We at MACH37 know that the future of our global economy is concerning at best, but we want to do our part to continue to empower innovation during these troubling times. That is why we have a devoted accelerator program for early stage startup companies who are developing cyber related products and services and are ready to take their business to the next level through expanding their networks, learning key business approaches and seeking investment. We encourage those interested in being part of the cybersecurity and technological startup community to apply here to be part of the cyber change that MACH37 represents. If not, we hope this post gives you data-driven information about the future of our economy so you can plan accordingly.

**Disclaimer: MACH37 does not have any concrete information about the future of the economy and predictions included herein should be taken accordingly.

Who Are We?

VentureScope works with creative entrepreneurs, venture capital investors, and large private and public sector organizations around the world that are trying to solve interesting problems. Our team has extensive and unique experience launching new business ventures, investing in promising startups, running startup accelerators, and providing strategic innovation and general management consulting services to large private and public sector organizations. We’re on the pulse of emerging and over-the-horizon technology and are tracking their growth and development against important industry problems to inform our deal flow and give you exceptional advice. MACH37 is our start-up accelerator designed to facilitate the creation of the next generation of cyber product companies.

References:

1 - https://blocksandfiles.com/2022/05/31/venture-capitalists-startup-funding-warning/

2 - https://www.cnbc.com/2022/06/15/what-to-do-with-your-money-after-fed-raises-interest-rates.html#:~:text=In%20its%20increasingly%20urgent%20battle,range%20of%201.5%25%2D1.75%25.

3 - https://www.pewresearch.org/fact-tank/2022/06/15/in-the-u-s-and-around-the-world-inflation-is-high-and-getting-higher/#:~:text=According%20to%20the%20latest%20report,same%20extent%20as%20the%20CPI.

4 - https://news.crunchbase.com/business/2022-vc-funding-outlook-compare-2008-financial-crisis-pandemic/ (In-Text and Infographics 1-4)

5 - https://techcrunch.com/2012/03/18/startups-and-economic-recovery/

6 - https://www.forbes.com/sites/trevornace/2017/12/13/violent-storm-133000-lightning-strikes-just-hours-australian-coast/?sh=518ba47336f3 (Image)